The City of Boston is home to some of the top universities, hospitals and cultural centers in the world.

Those institutions are a point of pride for the city and also economic engines that have helped make Boston the thriving, growing city it is today,

But there is a downside: As nonprofits, universities, hospitals, and museums do not pay property taxes in Massachusetts. And Boston’s largest nonprofits own a lot of land – increasingly valuable land that goes un-taxed.

In August, the City of Boston released the latest results from the city’s Payment In Lieu of Taxes, or PILOT program, an initiative in which the city essentially asks its largest nonprofits to make voluntary payments – a fraction of the property taxes they would owe if they were not exempt.

And every year a lot of those institutions fall short of those requests, especially when it comes to cash payments.

In 2018, only 13 of the 47 nonprofits in the city’s PILOT program contributed the requested amount – including fewer than a quarter of universities and colleges in the city.

To be sure, those institutions contribute contribute more than just the PILOT payments they make. The city itself generally attributes half of a nonprofit's PILOT payment to a "Community Benefits Credit." And many of the nonprofits who have declined to meet the city's cash request have defended their overall contributions to the city.

And City officials have emphasized the PILOT program's success over its challenges, noting correctly that the program has collected more revenue for the city every year.

But an analysis by the WGBH News Data Desk suggests another interpretation of the program’s success.

While the city has increased its “ask” in terms of PILOT payments, and while those payments have increased overall, the proportion of what many of Boston’s largest nonprofits are contributing – relative to the actual value of their property – has in many cases decreased, and drastically.

That’s in part because among the many quirks of Boston’s PILOT program is this one: The calculation by which the city determines how much it will ask from each nonprofit is based not on current property values – but on property values set nearly a decade ago, in 2011.

Property values across the region have, of course, increased since then – substantially, in many places.

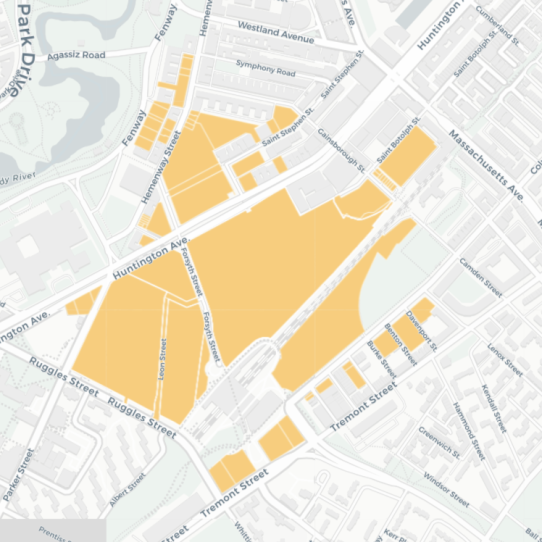

But many of Boston’s largest nonprofits – its universities, in particular, have also expanded and developed substantially their land.

And a WGBH analysis of the city’s property data suggests that those values have changed drastically since 2011.

WGBH analyzed property assessment data for Boston’s four largest educational institutions: Harvard, Northeastern, Boston College and Boston University.

All four have seen the value of their property increase drastically since 2011, whether by expansion and development or by virtue of simple market forces.

Among the four institutions of higher learning alone, the city’s requested PILOT payments essentially look past a combined growth in value of roughly $2.7 billion.

The findings echo a recent report on the city’s PILOT program commissioned by the PILOT Action Group, a coalition of activists, union members and neighborhood leaders. Among the report's findings was that collectively, Boston nonprofits have fallen short of the city's requests by more than $77 million over the years, and that even though the dollar amount of PILOT contributions has increased year over year, those contributions have in many cases been decreasing relative to the city's requests -- even as the city's requests are derived from 8-year-old valuations.

“My property value, your property value, we know every year it’s been going up,”says Enid Eckstein, a co-author of that report, “– yet the city has not applied that same metric, from what we understand, to the buildings that are part of the pilot program.”

Eckstein was one of more than a dozen experts, activists and residents to testify at a recent City Council hearing on the PILOT program.

Boston City Councilor Annissa Essaibi-George, who sponsored the hearing along with Councilor Lydia Edwards, also highlighted the widening gap between what residents do have to pay in property taxes – and what nonprofits don’t.

“The taxpayers of the city of Boston don't have an opportunity to not fulfill their requirement in paying property taxes,” Essaibi-George said in opening remarks.

“In fact, they are regularly re-evaluated and reassessed and almost always at higher amount.”

WGBH News reached out to the four largest universities in the city's PILOT program for comment.

A spokesperson for Northeastern University, which in 2018 was credited with contributing just 13% of the city's $11 million request, wrote in an email: "It is important to remember that PILOT contributions are voluntary, and Northeastern's engagement with the city goes far beyond those payments," citing as one example the school's $100 million investment to upgrade and maintain a city-owned playground.

A spokesperson for Boston College, which in 2018 was credited with contributing 10% of the city's $3.6 million request contributed wrote that "Boston College does not participate in the PILOT program, which is voluntary," describing the $335,000 the college was credited with in the PILOT program as an annual "payment for municipal services."

Harvard University, which contributed 79% of the city's overall request -- though just over half of the city's roughly $6 million cash request, did not return a request for comment. Boston University, which contributed 87% of the city's overall request, although about $6 million in cash compared to the city's $8 million cash request, also did not return a request for comment.

Harvard

Value of Exempt Property: $2.6 billion

Tax Bill Would Be: $65 million

City’s PILOT Request (Cash): $6.2 million

Harvard’s Cash Contribution: $3.6 million

Northeastern

Value of Exempt Property: $2 billion

Tax Bill Would Be: $50 million

City’s PILOT Request (Cash): $5.5 million

Northeastern’s Cash Contribution: $1.5 million

Boston College

Value of Exempt Property: $700 million

Tax Bill Would Be: $17.6 million

City’s PILOT Request (Cash): $1.8 million

Boston College’s Cash Contribution: $347,000

Boston University:

Value of Exempt Property: $2.5 billion

Tax Bill Would Be: $63 million

City’s PILOT Request (Cash): $8.3 million

Boston University’s Cash Contribution: $6.1 million

DISCLAIMER: WGBH makes PILOT contributions to Boston, meeting 100 percent of the sum requested.